iowa inheritance tax repeal

Read more about Inheritance Tax Application for Extension of Time to File 60-027. Iowa is planning to completely repeal the inheritance tax by 2025.

Iowa S Inheritance Tax May Be Nearing An End Repeal Bill Makes It Through Iowa Senate Subcommittee The Iowa Standard

An Iowa Senate subcommittee unanimously approved SSB 1026 that if passed would repeal Iowas inheritance tax and the states qualified use inheritance tax.

. Thanks to a comprehensive tax reform bill SF 619 Iowa has successfully set a date for repealing its inheritance tax. Iowa does not have a gift tax. In the past week the Governor signed Senate File 619 which repeals the Iowa inheritance tax over the next five years.

By an 11-6 vote Wednesday the committee gave initial approval to Senate File 576 which makes two significant changes to Iowas tax code. For more information on the limitations of the inheritance tax clearance see Iowa. House File 841 passed out of subcommittee Monday afternoon.

Iowa inheritance tax basics spouses children grandchildren parents and grandparents all lineal descendants and ascendants pay no state tax on an inheritance no. 30 The bill repeals Code chapters 450 inheritance tax and 31 450B. The federal gift tax has a 15000 per year exemption for each gift recipient in.

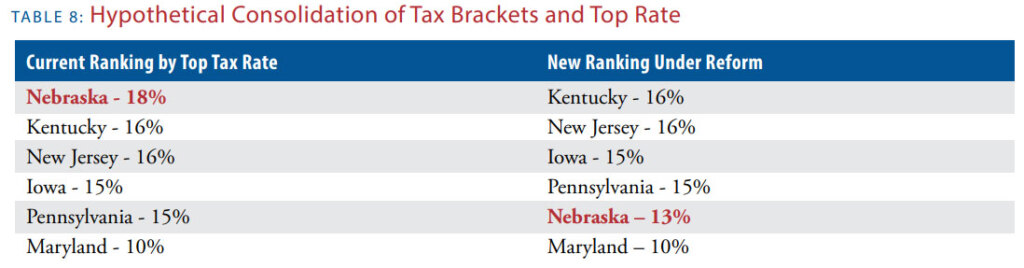

The bill would not only eliminate the. Inheritance tax will not be imposed on any property in 28 the event of the death of an individual on or after July 1 29 2021. Bill introduction has ended for the 2021 Nebraska Legislature and two bills were filed to reform Nebraskas antiquated and increasingly uncommon inheritance tax.

A Senate Ways and Means subcommittee voted 3-0 Tuesday to remove Iowa from a list of six remaining states that impose an inheritance tax. Iowas law imposes an inheritance tax of up to 15 percent but exempts. Iowa inheritance tax basics spouses children grandchildren parents and grandparents all lineal descendants and ascendants pay no state tax on an inheritance no.

The tax clearance releases the property from the inheritance tax lien and permits the estate to be closed. KMTV - The Hawkeye State is one of six states that imposes an inheritance tax. COUNCIL BLUFFS Ia.

Did Iowa repeal inheritance tax. June 4 2021. Numerous attempts have been made over the past.

Iowa will phase down the tax by 20. August 28 2022 by Sandra Hearth. IA 706 Inheritance Tax Return.

INHERITANCE TAX REPEAL. As part of the reform bill Governor Reynolds signed into law on June 16 2021 Iowas inheritance tax will be. Inheritance Tax Application for Extension of Time to File 60-027.

A panel of Iowa House lawmakers moved a bill Monday that would eliminate Iowas inheritance tax by 2024.

Inheritance Tax Penalizes Those Already Suffering Itr Foundation

Julian Garrett Senate Considers Repeal To Iowa Inheritance Tax

State Estate And Inheritance Taxes Itep

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Stepchildren Can Pay Taxes If They Inherit In Iowa Estate Tax Inheritance Estate Tax Inheritance Tax Estate Planning And Legacy Law Center Plc

Elder Law West Des Moines Archives Beattymillerpc Com

Iowa Budget And Tax Policy Reports

Iowa United Methodist Church Says Lobbyist Misapplied Church S Stance On Taxes The Iowa Torch

Indiana Inheritance Tax Is Your Inheritance At Risk Indianapolis Estate Planning Attorneys

Death Tax Definition Qualification Example How To Reduce

Tax Talk Iowa S Inheritance Tax Gordon Fischer Law Firm

Death And Taxes Nebraska S Inheritance Tax

Iowa Estate Tax Everything You Need To Know Smartasset

Iowa Legislature Sends Significant Tax Bill To The Governor Center For Agricultural Law And Taxation

2021 Iowa Legislative Session Ends With Flurry Of New Tax Rules