corporate tax increase build back better

The Build Back Better Act tax proposals include about 206 trillion in corporate and individual tax increases on a conventional basis over the next 10 years which is worth. Corporate Americas relentless year-long lobbying campaign partially paid off this past weekend when Senate Democratsconstrained by two industry-allied lawmakers in their.

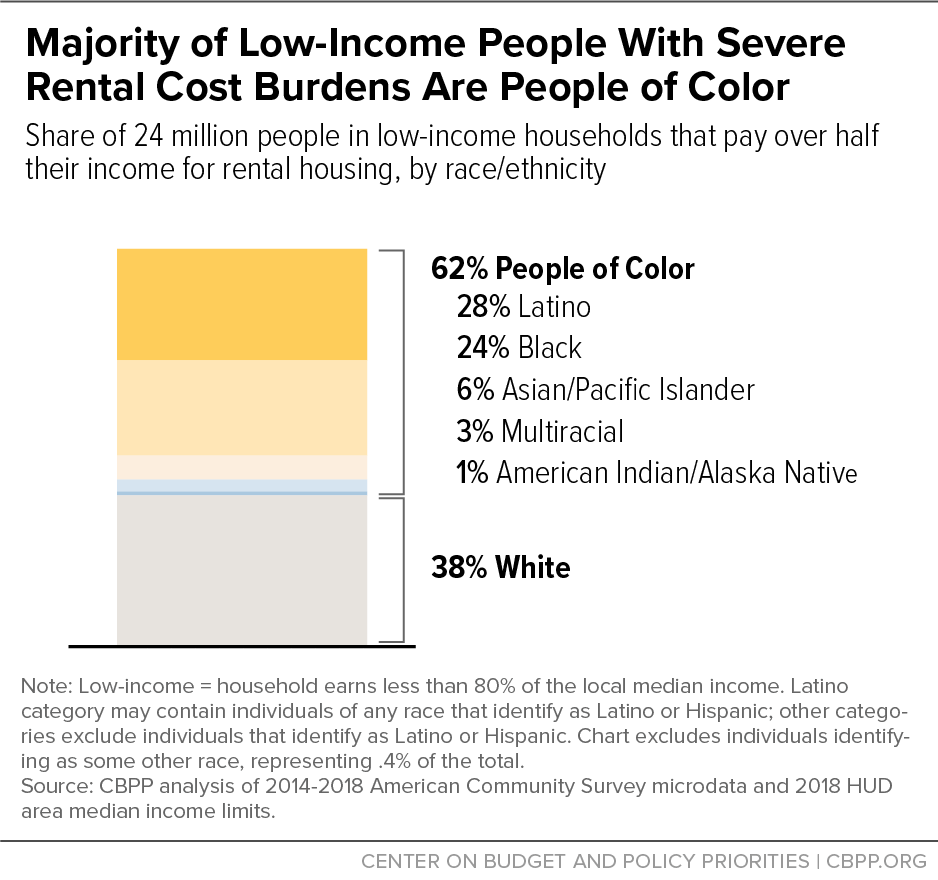

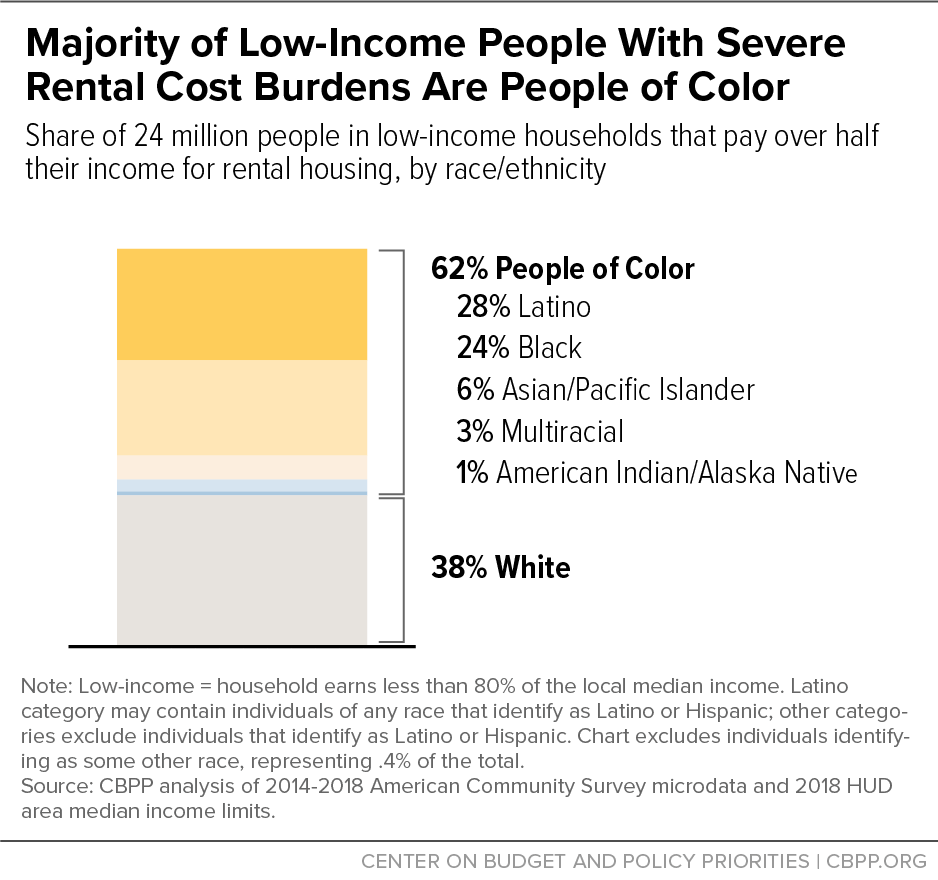

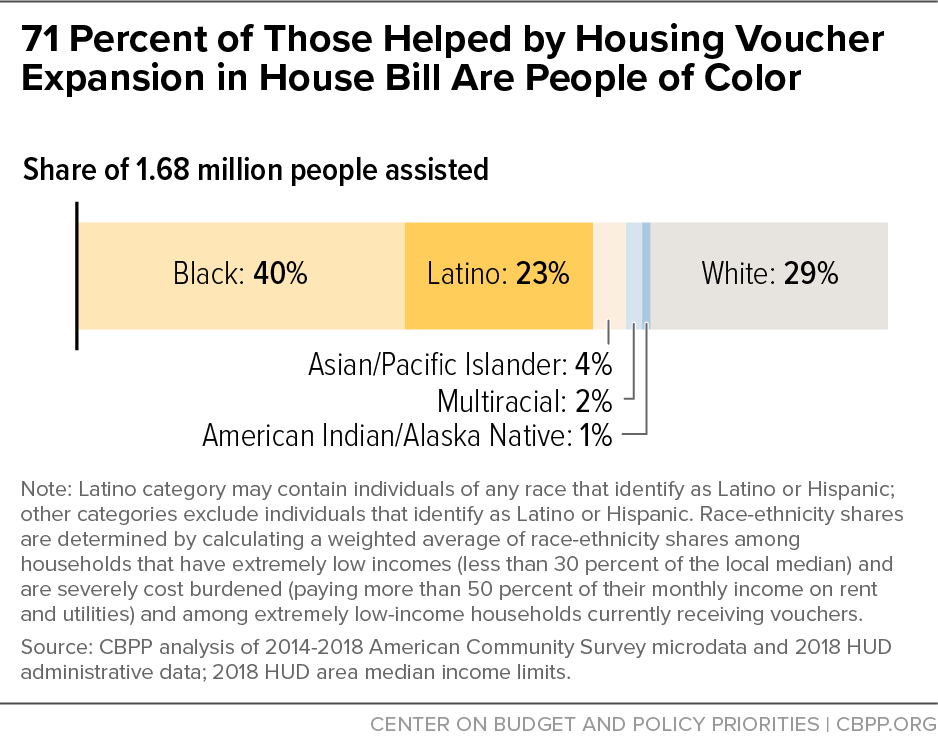

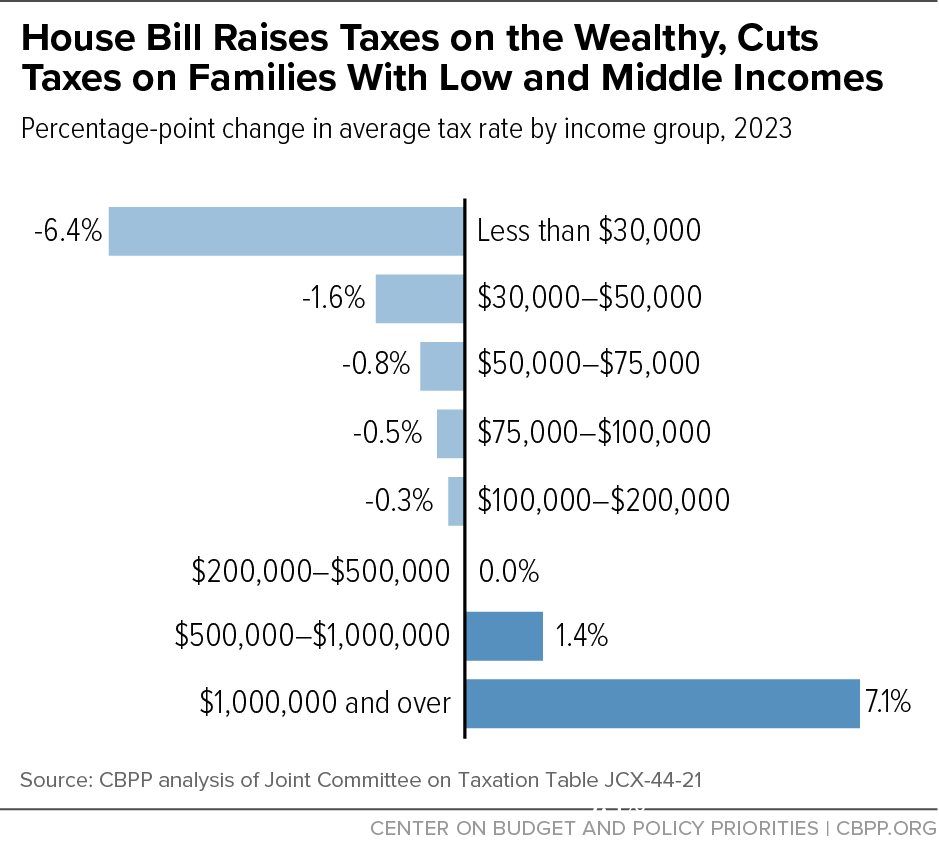

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Build Back Better Means Higher Business Taxes.

. January 2 2022. President Joe Bidens massive social safety net package known as Build. 1 surcharge on corporate stock buybacks.

OPINION The corporate tax increase proposal in Bidens infrastructure plan would hamstring the US. Democrats weigh a range of tax increases in revived Build Back Better plan. T he proposed 15 corporate alternative minimum tax CAMT based on book income would apply to companies that report over 1 billion in profits to shareholders.

It states that taxes for. Multinational corporations and includes strong. Individual and pass-through tax.

This proposed change would be effective in tax years after December 31 2021. Impose a 15 percent minimum tax on corporate book income for corporations with profits over 1 billion-01-01-03-01-27000. Economic comeback and hurt us globally.

Increase to individual tax rate Top. Raising the corporate tax rate to 28 would give the US. Create a 1 excise tax on net stock.

Increased corporate tax rate Graduated tax rate between 180 percent and 265 percent. 5376 that includes more than 15 trillion in business international and individual tax. Corporate Tax Rate Increase.

The highest tax rate on job creators among our international competitors making us far less desirable as a destination for. The House on November 19 voted 220 to 213 to pass the Build Back Better reconciliation bill HR. Build Back Better Requires Highest-Income People and Corporations to Pay Fairer Amount of Tax Reduces Tax Gap Requiring High-Income Individuals to Pay Fairer Amount of.

The Build Back Better Act as currently passed by the House imposes a tax on share repurchases of corporate stock effective January 1st 2022. Report Illustrates How 70 Corporations Could Be Affected by Minimum Tax Proposal in the Build Back Better Act. Since the start of the new term the Biden Administration has been focused on passing comprehensive legislation to overcome.

Amazon Bank of America Facebook FedEx General. The Build Back Better Act adopts the agreed-upon 15 country-by-country minimum tax on the foreign profits of US. The corporate minimum tax as proposed in Build Back Better would be 15 of book income for corporations with financial statement income in excess of 1 billion.

New IRC 4501. Corporate Tax Policy in Build Back Better Douglas Holtz-Eakin Shortly after the election AAF took a close look at the Build Back Better agenda and concluded that the. Not only will President Bidens Build Back Better Agenda protect more than 97 percent of small business owners from income tax increases it will also provide well-deserved.

The corporate flat tax rate of 21 would be replaced with a three. The Build Back Better Bill also known as the Build Back Better Act is structured to support the middle class and expand the economy. The bill would impose a tax equal to 1 of the fair market value of any stock of a corporation that the corporation repurchases.

Ev Tax Credits In Biden S Build Back Better Act Will Help Sell More Cars Than New Chargers

Jessejenkins On Twitter It S Out Repeat Project S Analysis Of The Climate Amp Energy Impacts Of The Inflation Reduction Act Nearing A Vote In The Senate At Https T Co 6zdwaadcml The Act Would 1 Cut

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

The Build Back Better Framework The White House

Potential Costs And Impact Of Health Provisions In The Build Back Better Act Kff

The Build Back Better Framework The White House

The Build Back Better Framework The White House

Build Back Better Joe Biden S Jobs And Economic Recovery Plan For Working Families Joe Biden For President Official Campaign Website

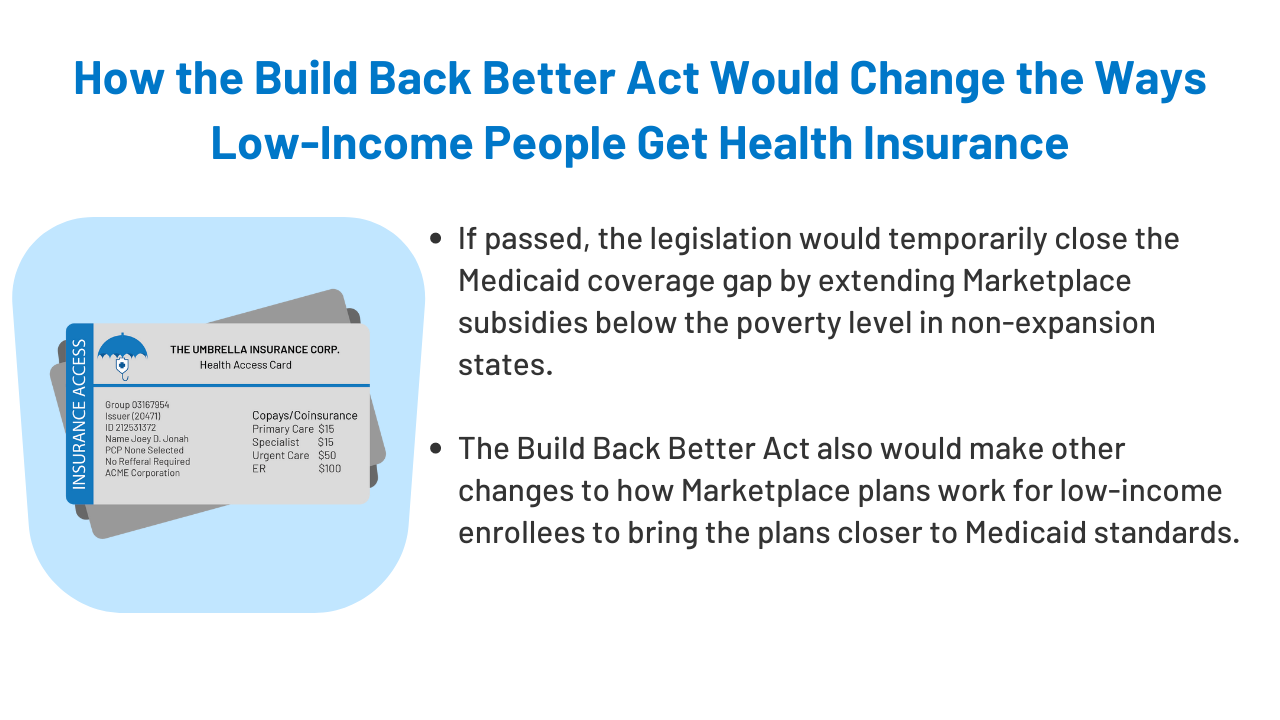

Build Back Better Would Change The Ways Low Income People Get Health Insurance Kff

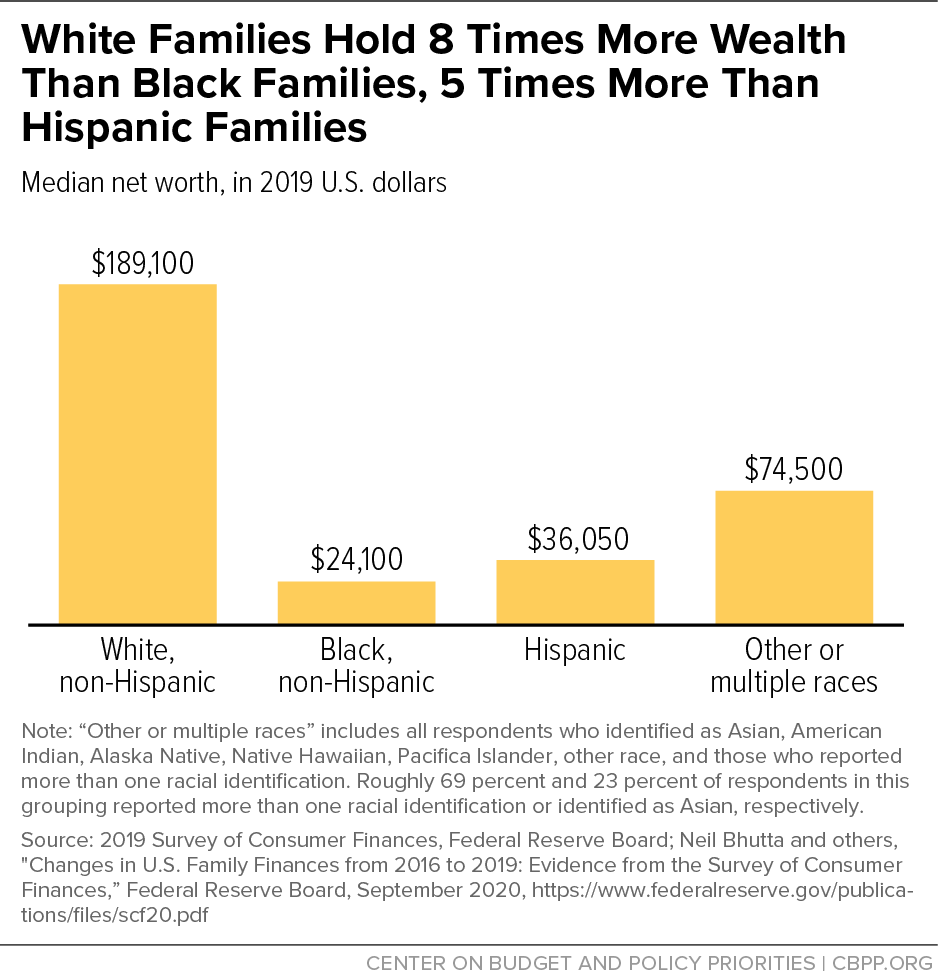

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

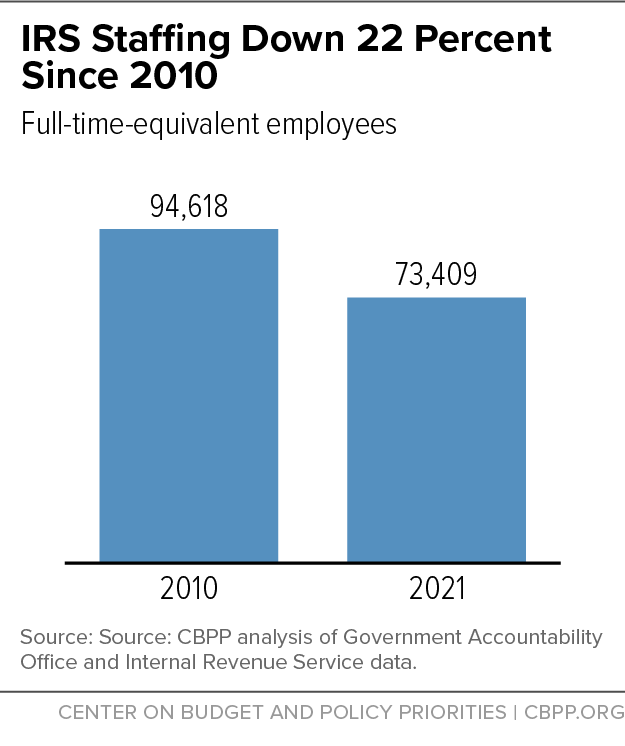

Congress Needs To Take Two Steps To Fund The Irs For The Short And Long Term Center On Budget And Policy Priorities

The Build Back Better Framework The White House

Retrofit Or Build New How Product Teams Are Choosing Energy Efficient Construction Building Old Building

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

The Build Back Better Framework The White House

The Build Back Better Framework The White House

Tobacco Taxes Are Win Win Win Tax4health International Health How To Plan World Health Organization

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities